美国上市公司盈余管理计算方法

0 准备工作

预处理 CCM 数据库

见我的上期文章:WRDS 实战 - CCM 的下载与预处理

1 盈余管理计算方法

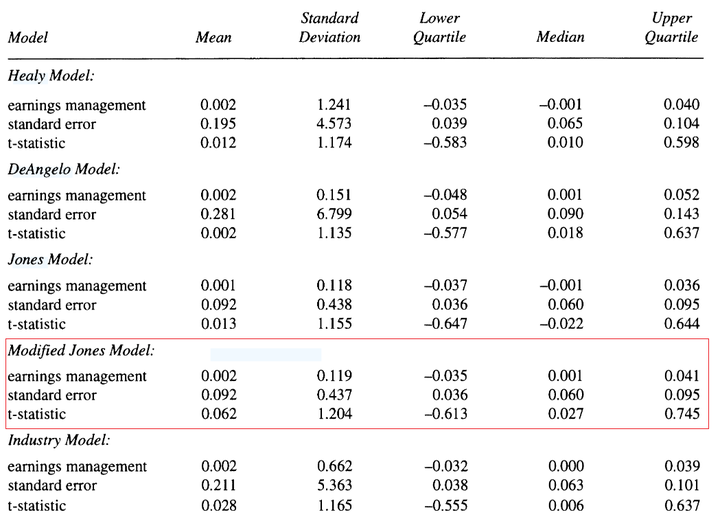

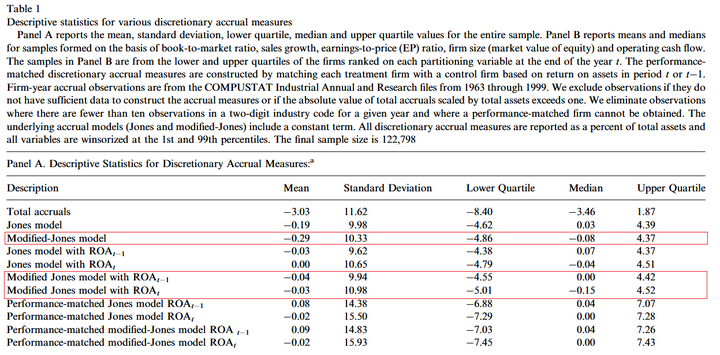

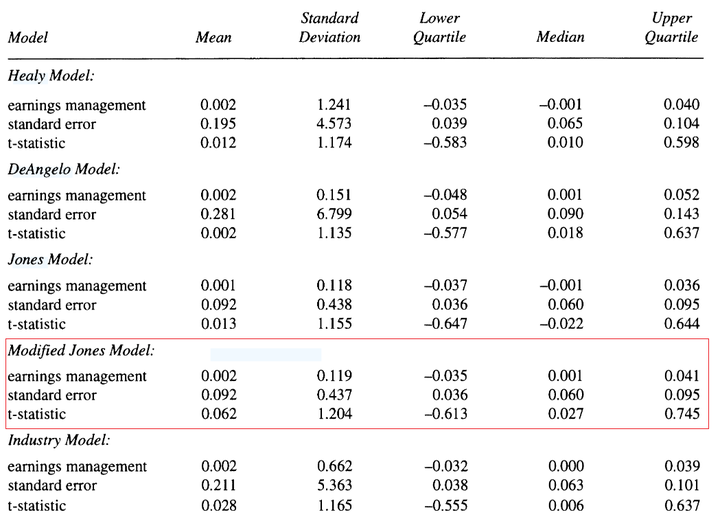

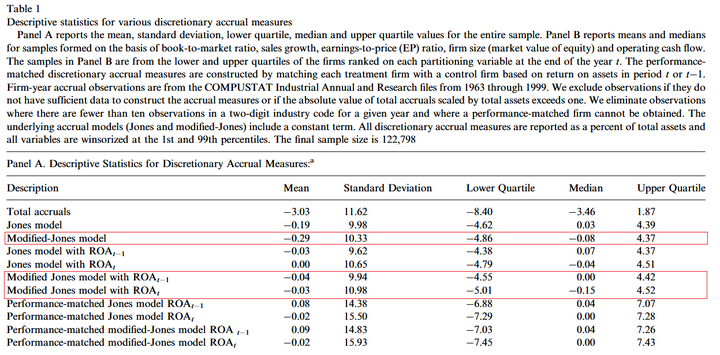

这里主要介绍 Dechow et al.(1995)和 Kothari et al.(2005)的做法

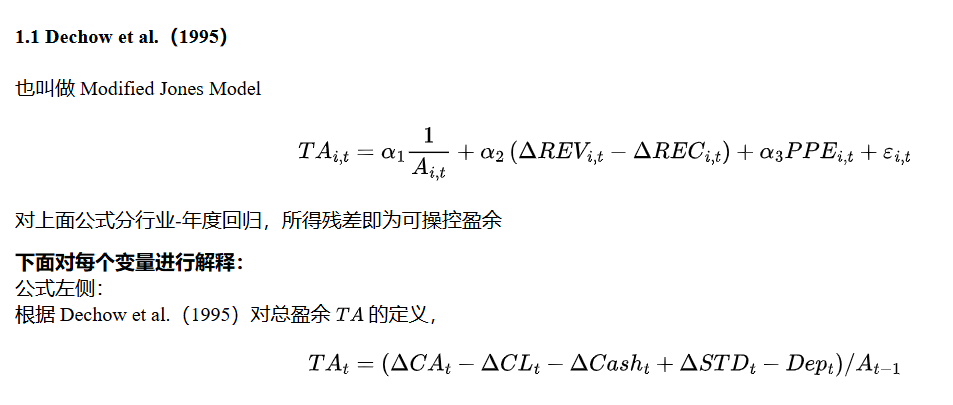

1.1 Dechow et al.(1995)

也叫做 Modified Jones Model

$$

TA_{i,t} = \alpha_1 \frac{1}{A_{i,t}} + \alpha_2 \left( \Delta REV_{i,t} - \Delta REC_{i,t} \right) + \alpha_3 PPE_{i,t} + \varepsilon_{i,t}

$$

对上面公式分行业-年度回归,所得残差即为可操控盈余

下面对每个变量进行解释:

公式左侧:

根据 Dechow et al.(1995)对总盈余 $TA$ 的定义,

$$

TA_{t} = \left(\Delta CA_{t} - \Delta CL_{t} - \Delta Cash_t + \Delta STD_{t} - Dep_{t}\right) / A_{t-1}

$$

其中,

- $CA$ 为流动资产(current assets),在 Compustat 字段为

act

- $CL$ 为流动债务(current liabilities),在 Compustat 字段为

lct

- $Cash$ 现金及其等价物(短期投资)(cash and cash equivalents),在 Compustat 字段为

che(注意与 ch 区分)

- $STD$ 为流动债务中的负债(debt),在 Compustat 字段为

dlc

- $Dep$ 为折旧及摊销费用(depreciation and amortization),在 Compustat 字段为

dp

公式右侧:

- $A$ 为总资产(total assets),在 Compustat 字段为

at

- $REV$ 为营业收入,在 Compustat 字段为

revt

- $REC$ 为应收账款(按理来说应该是应收账款净额,但是我发现净额在数据库中太少了),在 Compustat 字段为

rect

- $PPE$ 为固定资产(Property, Plant and Equipment),在 Compustat 字段为

ppegt(注意用 gross 而不是 net)

1.2 Kothari et al.(2005)

其实就是在 Dechow 基础上加了个 $ROA$

$ROA$ 为净收入除以当期或者上一期总资产。净收入在 Compustat 字段为 ni

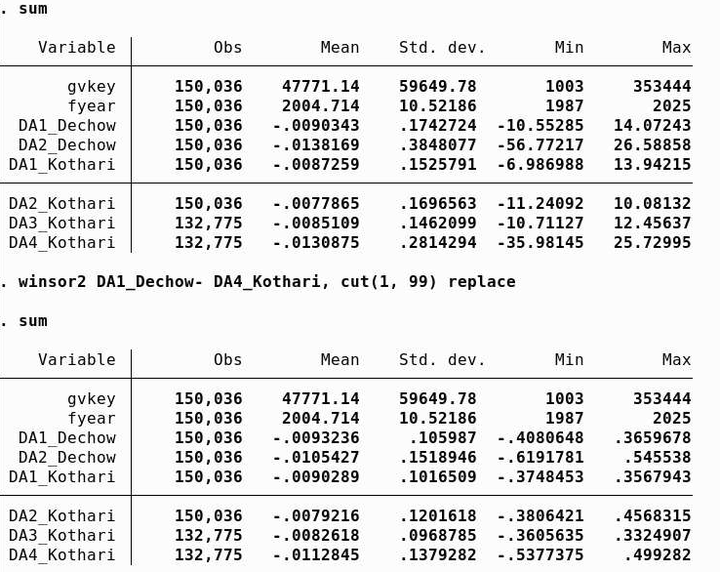

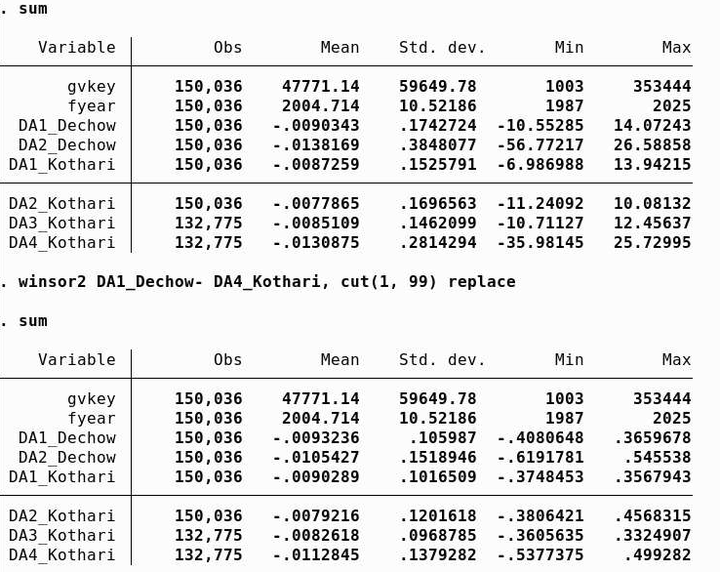

2 Stata 实践

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

| use "CCM.dta", clear

xtset gvkey fyear

gen delta_CA = D.act

gen delta_Cash = D.che

gen delta_CL = D.lct

gen delta_DCL = D.dlc

gen lag_A = L.at

gen TACC1_ta = (delta_CA - delta_Cash - delta_CL + delta_DCL - dp) / lag_A

gen TACC2_ta = (ni - oanfc) / lag_A

gen delta_REV = D.revt

gen delta_REC = D.rect

gen term2 = (delta_REV - delta_REC) / lag_A

gen one_ta = 1 / lag_A

gen PPE_ta = ppegt / lag_A

drop if missing(TACC1_ta, TACC2_ta, one_ta, term2, PPE_ta)

gen sic2 = real(substr(string(sic), 1, 2))

drop if missing(sic2)

asreg TACC1_ta one_ta term2 PPE_ta, by(sic2 fyear) fitted noconstant

ren _residuals DA1_Dechow

drop _Nobs-_fitted

asreg TACC1_ta one_ta term2 PPE_ta, by(sic2 fyear) fitted noconstant

ren _residuals DA2_Dechow

drop _Nobs-_fitted

gen ROA = ni / lag_A

gen LROA = L.ni / lag_A

asreg TACC1_ta one_ta term2 PPE_ta ROA, by(sic2 fyear) fitted noconstant

ren _residuals DA1_Kothari

drop _Nobs-_fitted

asreg TACC1_ta one_ta term2 PPE_ta ROA, by(sic2 fyear) fitted noconstant

ren _residuals DA2_Kothari

drop _Nobs-_fitted

asreg TACC1_ta one_ta term2 PPE_ta ROA, by(sic2 fyear) fitted noconstant

ren _residuals DA3_Kothari

drop _Nobs-_fitted

asreg TACC1_ta one_ta term2 PPE_ta ROA, by(sic2 fyear) fitted noconstant

ren _residuals DA4_Kothari

drop _Nobs-_fitted

keep gvkey fyear DA1_Dechow DA2_Dechow DA1_Kothari DA2_Kothari DA3_Kothari DA4_Kothari

compress

save "Earnings managements", replace

|

3 结果展示

计算结果

原文